Cheap Auto Insurance Tallahassee: Smart Ways to Save in

Looking for cheap auto insurance in Tallahassee without compromising coverage? You’re not alone. With rising living costs and Florida's unique auto insurance requirements, finding an affordable policy in the capital city can be tricky—but it’s not impossible. This guide reveals practical tips, local provider insights, and expert advice to help you get the best coverage at the lowest rates.

Why Auto Insurance Is Expensive in Tallahassee—and How to Beat the Trend

Tallahassee drivers face higher premiums than the national average due to Florida’s no-fault insurance laws, high accident rates, and frequent weather-related claims. But knowing where to look and what factors impact your rate can make a big difference.

Key Factors That Affect Auto Insurance Rates:

-

Driving record and accident history

-

Vehicle type and age

-

Credit score (some insurers consider this in Florida)

-

Zip code (areas with higher crime or traffic raise costs)

-

Coverage level and deductible

5 Local Tips to Get Cheap Auto Insurance in Tallahassee

Finding affordable insurance isn't just about luck—it’s about strategy. Here are five proven ways to reduce your auto insurance costs in Tallahassee.

-

Shop Around and Compare Quotes

Don’t settle for the first quote. Use comparison tools or get quotes from at least three insurers. -

Raise Your Deductible

A higher deductible means lower monthly premiums—just be sure you can afford it if you file a claim. -

Bundle Policies

Combine your auto and renters or homeowners insurance with the same provider to unlock discounts. -

Maintain a Clean Driving Record

Safe drivers often receive substantial savings after a few years without accidents or violations. -

Ask About Discounts

Some Tallahassee providers offer discounts for:-

Good students

-

Defensive driving course completion

-

Military/veterans

-

Low-mileage drivers

-

Best Local Providers for Cheap Auto Insurance Tallahassee Residents Trust

When it comes to saving money, some insurers in Tallahassee stand out for their rates and service. Here are a few worth checking:

1. GEICO Tallahassee

Known for competitive pricing and online tools.

2. State Farm

Offers great discounts for students and safe drivers.

3. Direct Auto Insurance

Specializes in high-risk drivers and SR-22 filings.

4. Acceptance Insurance

Offers flexible payment plans and bilingual services.

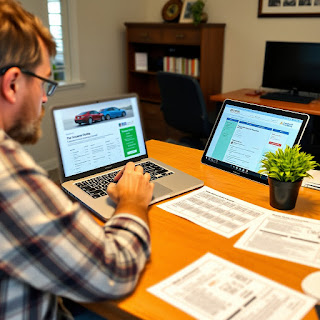

How to Use Online Tools to Compare and Save Instantly

Don't have time to call every provider? Use online tools and quote engines to get multiple estimates in minutes. Many comparison sites now offer side-by-side breakdowns of coverage, premiums, and discounts.

Recommended Comparison Platforms:

-

The Zebra

-

Compare.com

-

NerdWallet

-

Insurance.com

Pro Tip: Be honest when entering your info—small inaccuracies can skew your quote or lead to cancellation later.

Conclusion: Drive Smart, Insure Smarter

Getting cheap auto insurance in Tallahassee doesn’t mean cutting corners—it means being informed and strategic. Whether you're a student at FSU, a daily commuter, or a retiree enjoying sunny Florida roads, you can lock in affordable coverage by comparing providers, asking about discounts, and tailoring your policy to fit your needs.

FAQ: Cheap Auto Insurance in Tallahassee

Q1: What's the cheapest car insurance company in Tallahassee?

GEICO and Direct Auto often offer some of the lowest rates, but it depends on your driving history and coverage needs.

Q2: Can I get cheap auto insurance in Tallahassee with a bad driving record?

Yes. Companies like Direct Auto and Acceptance Insurance specialize in high-risk coverage with flexible payment options.

Q3: Are online quotes accurate for Tallahassee drivers?

They’re a good starting point, but always verify details directly with the insurer to ensure accuracy.

Q4: Does Florida require full coverage auto insurance?

No, only personal injury protection (PIP) and property damage liability are required, but full coverage is recommended for newer vehicles.

Q5: How much can I save by bundling home and auto insurance in Tallahassee?

Bundling can save you up to 20% or more, depending on the provider.

Comments

Post a Comment